Outdated or Unsupported Browser Detected

DWD's website uses the latest technology. This makes our site faster and easier to use across all devices. Unfortunatley, your browser is out of date and is not supported. An update is not required, but it is strongly recommended to improve your browsing experience. To update Internet Explorer to Microsoft Edge visit their website.

Unemployment Insurance (UI) Claimant Handbook

![]()

When you claim UI, you must complete 4 tasks to remain eligible:

Failure to complete any of these actions may disqualify you from future UI.

You must register for work with the Job Center of Wisconsin within 14 days of the date you complete your initial claim application for UI to be eligible. This includes completing and activating a résumé. If you fail to register by the deadline, you may be denied benefits for any week before the date you register.

If this requirement is waived, you will be notified on your Claimant Portal.

Register for work with the Wisconsin Job Center online at https://JobCenterofWisconsin.com/ui.

If you have previously registered for work, you must verify that your registration and résumé have not expired at https://JobCenterofWisconsin.com/ui.

If you live out of state, you may be required to report to the public employment office nearest your home, register for work, and submit proof of registration to DWD. Proof can include a screenshot with the date of your completed registration, an email confirmation of registration, or a copy of the completed registration.

More information about the registration for work requirement and waivers can be found in the Registration for Work FAQ.

If you have questions or need help registering, please visit your local Job Center: http://www.wisconsinjobcenter.org/directory or contact the Job Service Call Center toll-free at (888) 258-9966.

You must perform at least four actions to search for suitable work each week unless we notify you that the work search requirement is waived. Suitable work is work that is reasonable considering your training, experience, length of unemployment, and availability of jobs.

Unemployed workers who conduct more than the four required work search actions find work faster than those who only complete the minimum each week.

You must document your work search actions for each week you claim UI. You will need enough details for us to verify your work searches. We may require proof of your work search actions. Keep proof of your work search actions for one year. For more information about the work search requirements and waivers, please see Work Search Requirements.

Falsely reporting information on your work search actions may be fraud, which can result in penalties and the denial of UI. For more information, please see Overpayments and Fraud and Quality Control.

You must file a weekly claim certification for each week that you want to receive UI. When you file a weekly claim certification, you notify us that you are still out of work or are still working reduced hours. We cannot pay UI to you for a week if you do not file a weekly claim certification for that week. The weekly claim certification includes a series of questions that help determine if you are eligible to continue receiving UI benefit payments. For example, you will be asked if you:

You are required to answer the questions truthfully for each week you claim UI. Failure to do so could result in loss of UI or other penalties.

The first day you can submit a weekly claim certification is the Sunday after you file your initial claim application. You must submit your weekly claim certification by 3:00 pm on the Saturday that is 14 days after the end of each week you are claiming benefits.

For example, if you lost your job on Monday the 3rd of the month, and filed an initial claim application that week, you could submit a weekly claim certification for your first week of UI starting on Sunday the 9th and must submit your claim for that week by 3:00 pm on Saturday the 22nd. If you fail to do so, your UI benefit payment may be delayed or denied.

File your weekly claim online during these times:

If you are unable to file your weekly claim certifications online, call the Help Center at (414) 435-7069 or toll-free (844) 910-3661 during business hours.

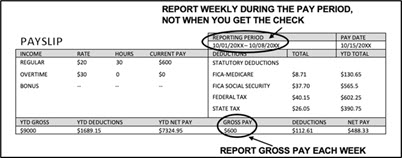

If you perform any work during a week that you are claiming UI, you must report how much money you earned. You must report your gross earnings, not your net earnings.

You must report your earnings in the week they were earned (the week that you worked), even if you have not yet been paid.

It is important that you keep track of all hours that you work and calculate the amount you may be owed by any employer.

While you may use a calendar, notebook, or spreadsheet to track this information, the United States Department of Labor also offers the DOL-Timesheet App for employees and employers to record work time and calculate pay.

Any money earned for work done must be reported. Common income sources include full-time or part-time employment, temporary or odd jobs, and tips.

You also must report working if you are working for a payment other than money. The value of any kind of remuneration or payment must be reported in the week the payment is earned. Wages are every type of pay for work done, including room and board, cash payments, tips, commissions and "working off a bill."

You must report other earnings and benefits, including any bonus pay, sick, holiday, vacation, or PTO pay, termination pay, severance packages, pay in lieu of notice, dismissal pay, pension or 401(k) from a previous employer in your benefit year, a continuation of pay with full benefits from an employer, or any worker's compensation benefits. These payments may affect your UI.

For more information, see Reporting Other Types of Income.

If you have any questions about what earnings to report, please call the Help Center at (414) 435-7069 or toll-free (844) 910-3661 during business hours.

Number of Hours Worked During the Week × Rate of Pay = Gross Earnings

For instance, if you worked 30 hours in a week at $20 per hour, you would report $600 in gross earnings for the week.

If you are not sure how many hours you worked during the week or what your rate of pay is, please contact your employer and request that information. Your wages must be reported in the week you worked even if you will not be paid until a later week. You should not wait until you receive a paycheck to report the wages or file your weekly claim certifications.

DWD will verify the wages you report on a weekly claim certification with your employers. Your UI benefit payment is based on the wages you report. If an employer provides a different amount, you will be sent a notice of adjustment. If you disagree with the notice of adjustment, follow the instructions on the reverse side of the notice to file an objection. If you object, DWD will investigate and resolve the discrepancy.

An overpayment may occur if you are paid unemployment benefits and are later found to not be eligible for those benefits because you failed to report your earnings.

If you intentionally make false statements or hide information about your earnings to gain or maintain UI benefits, you are committing fraud and may face penalties in addition to an overpayment. For more information, please see Overpayments and Fraud and Quality Control

If you are confused about what you are supposed to do or report, call (414) 435-7069 or toll-free (844) 910-3661 during business hours for clarification. We are here to help!

Updated: November 6, 2024